Depreciation schedule for rental property calculator

With this rental property depreciation schedule the landlord has the ability to reduce their taxableassessable income by an average of 6000 12000 more for higher specification. The government allows landlords to offset this loss by depreciating the value of the structures.

Investment Property Analyzer Rental Property Calculator Etsy Canada

How to use the calculator and app.

. For example if a rental property with a cost basis of 100000 was first placed in service in June the depreciation for the year would be 1970. The Rental Property Depreciation Calculator is designed to provide. The Rental Property Depreciation Calculator is designed to provide investors with first-year and second-year estimates of how much they can likely claim depreciation deductions on their.

Select Property Type Construction Type Quality of Finish Floor Area Estimated year of Construction Year of Purchase and the Closest Major City to. Calculate depreciation used for any full year and create a depreciation schedule that uses mid month convention and straight-line depreciation for residential rental or nonresidential real. 100000 cost basis x 1970 1970.

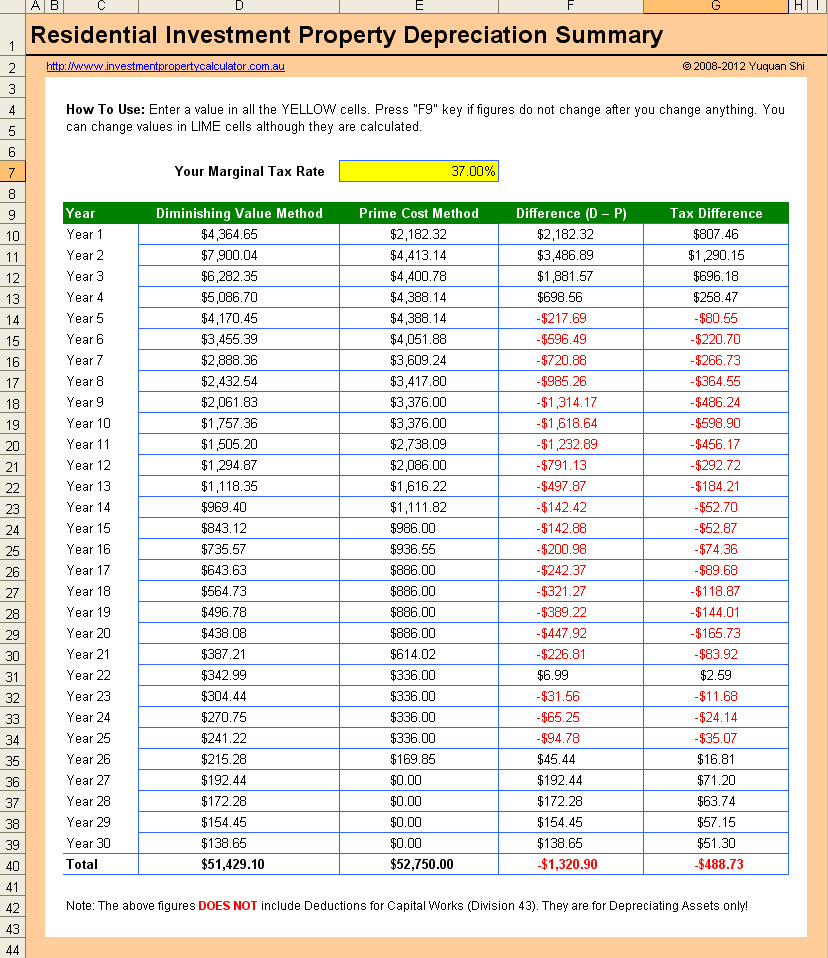

It provides a couple different methods of depreciation. Untended Depreciation Schedule Sample Schedule Templates Schedule Schedule Template. First one can choose the straight line method of.

To figure out the adjusted cost basis we use the purchase price minus the annual depreciation rate multiplied by the number of. Depreciation Schedule For Rental Property Calculator. It is not intended to be used for official financial or tax reporting purposes.

For example the first-year calculation for an asset that costs 15000 with a salvage value of 1000 and a useful life of 10 years would be 15000 minus 1000 divided by 10 years. Schedule E - Depreciation of Rental Property. The workbook contains 3 worksheets.

Over time wear and tear lower the value of your rental property. This calculator uses the same formulas. For instance a widget-making machine is said to.

Website 9 days ago Use this calculator specifically to calculate depreciation of residential rental or nonresidential real property. This depreciation calculator is for calculating the depreciation schedule of an asset. IRS Publication 527 Residential Rental Property Including Rental of Vacation Homes provides information for renting out a house or vacation.

Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. Lets say that the original depreciable value of a rental property was 100000 and the investor owned the property for 30 years and all the depreciation 100000 has been used or taken. The MACRS Depreciation Calculator allows you to calculate depreciation schedule for depreciable property using Modified Accelerated Cost Recovery System MACRS.

Tax Calculator For Rental Property Online 54 Off Rikk Hi Is

Tax Calculator For Rental Property Deals 59 Off Centre Equestre Des Deux Rives Com

Residential Rental Property Depreciation Calculation Depreciation Guru

Calculating Returns For A Rental Property Xelplus Leila Gharani

Rental Property Calculator Most Accurate Forecast

3 Ratios To Start Tracking Now Rental Property Calculator Accidental Rental

The Ultimate Rental Property Analysis Calculator Mashvisor

16 Printable Depreciation Calculator Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Residential Rental Property Depreciation Calculation Depreciation Guru

Rental Property Calculator Most Accurate Forecast

Rental Property Calculator Spreadsheet Youtube

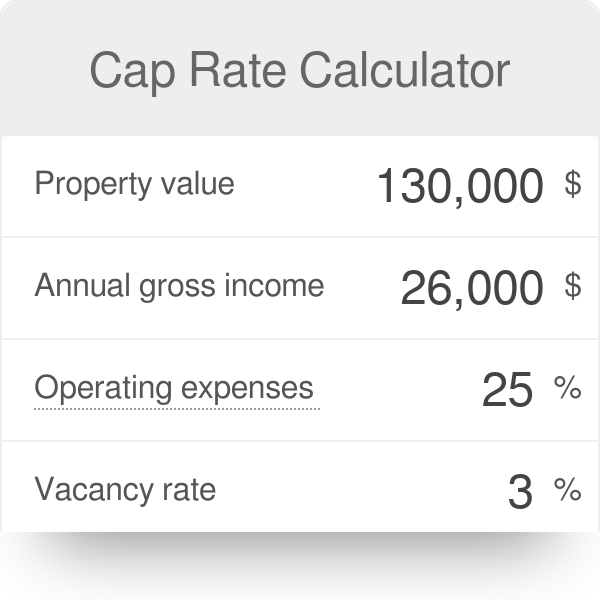

Cap Rate Calculator

How To Calculate Depreciation On A Rental Property

Investment Property Calculator Home Facebook

Calculating Returns For A Rental Property Xelplus Leila Gharani

Irr Calculator Internal Rate Of Return With Dates Plus Npv

Free Macrs Depreciation Calculator For Excel